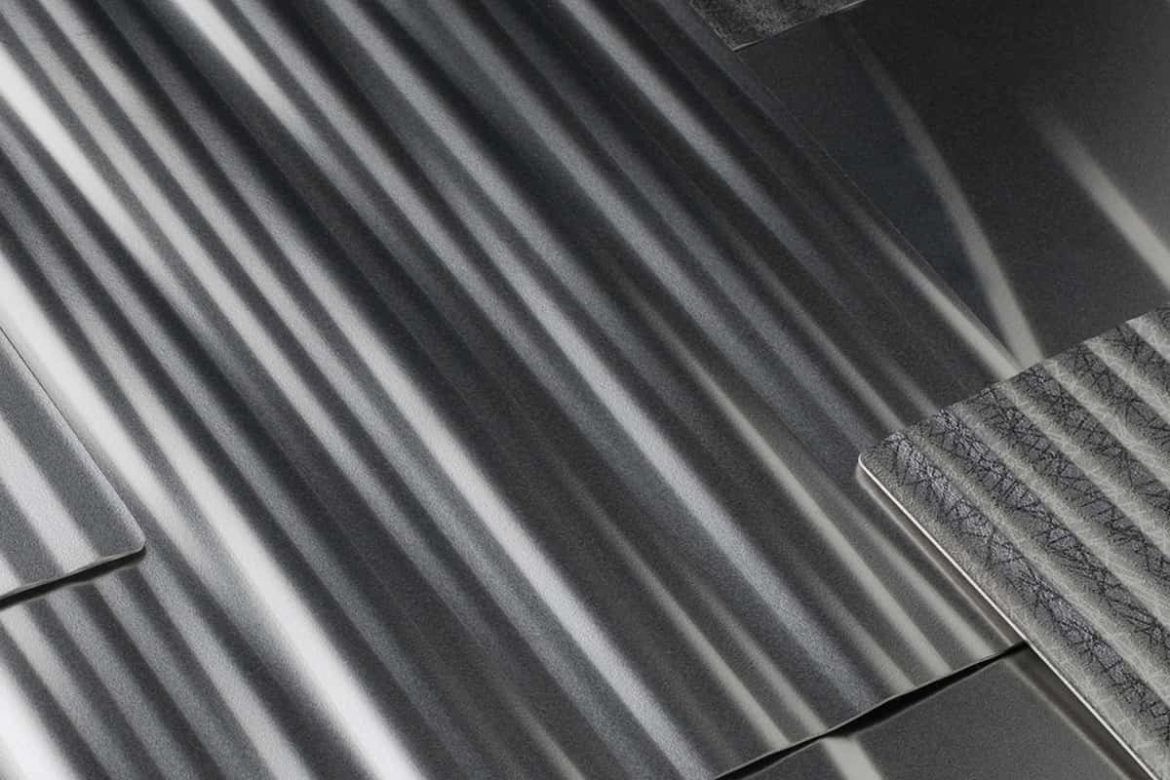

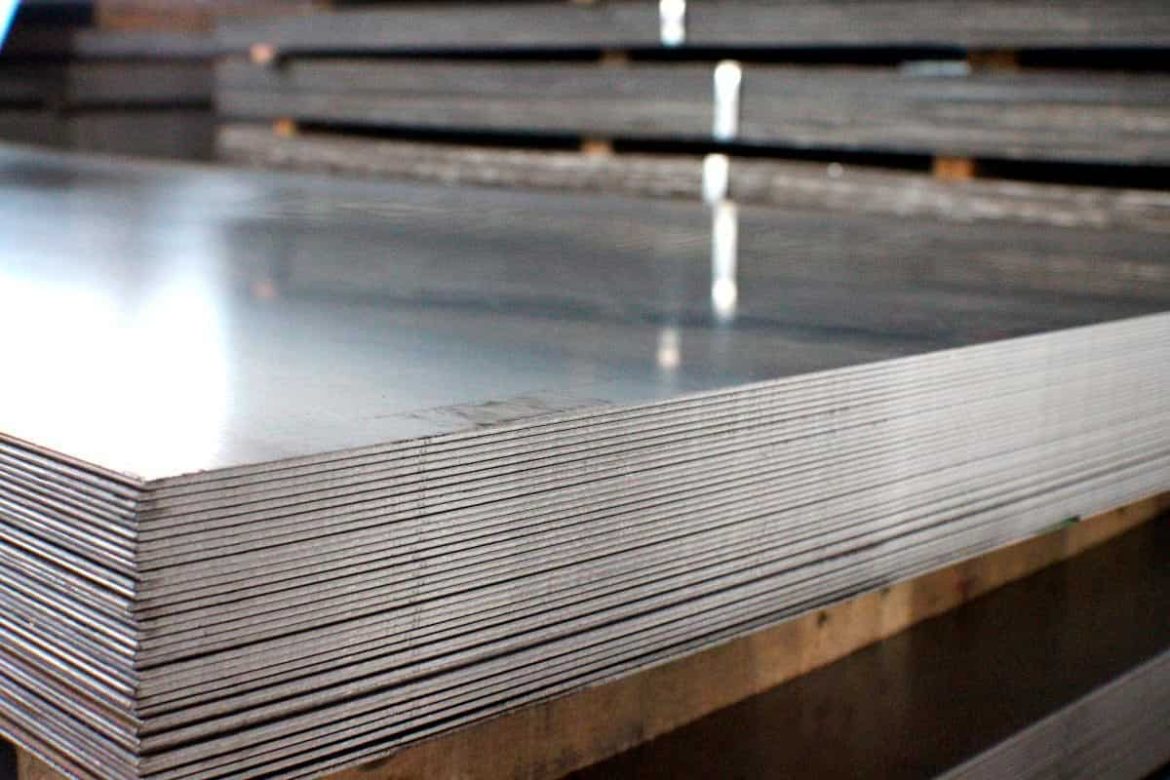

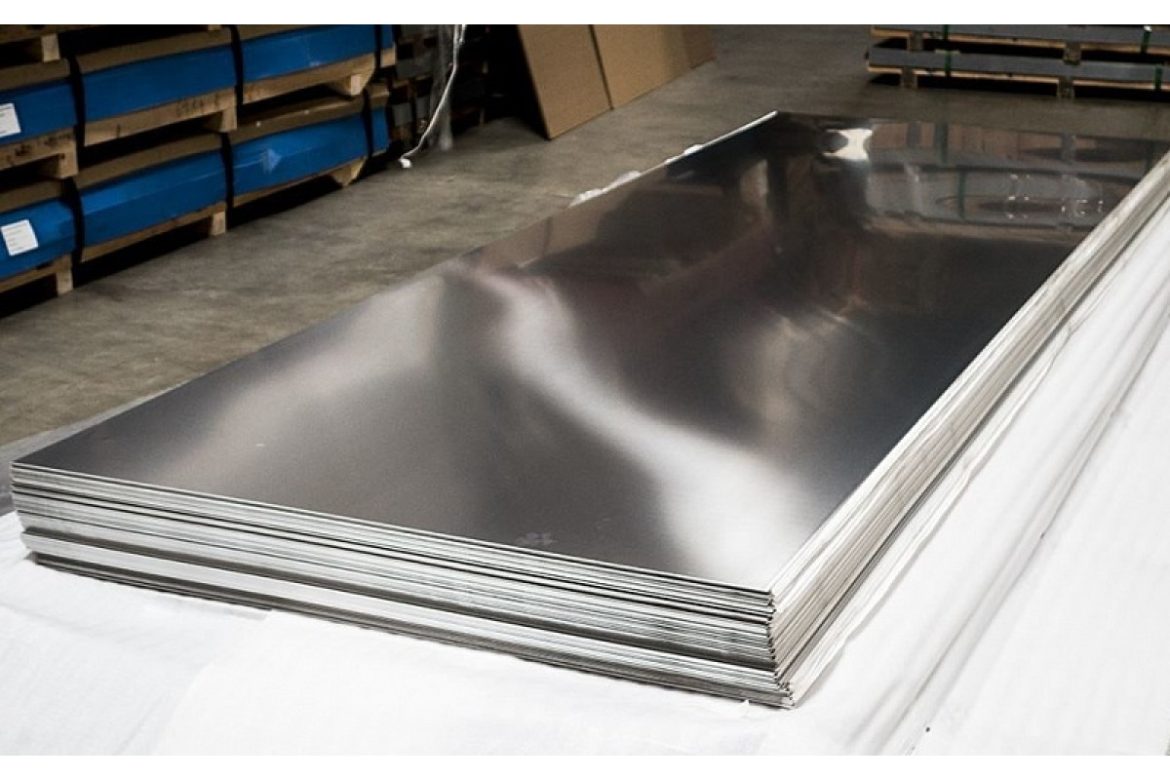

Copper comes in many forms and applications and the price of the rods on LME or London metal exchange is about 8000 or so. Of course, the price of them is calculated per ton. Copper is a reddish gold metal that is flexible, malleable and an efficient conductor of heat and electricity. Copper was the first metal used by humans and today it is one of the most widely used metals. Metals fall into two categories. Those that contain iron and are widely used in construction and industry are classified as ferrous metals, while those that do not contain iron are typically used for electrical conductivity, corrosion resistance, and other properties. By using antibacterial, they are classified as non-metallic. The latter is listed separately from the above properties for several reasons. Most metals that fall into this category are very obscure or hard to come by. Their ores are either embedded deep in the earth or rarely found.  In addition, the industries that use them also belong to a complex group, including electronics, telecommunications and aerospace. Among all non-ferrous metals, copper is undoubtedly the best. Everyone knows about gold and silver, but they don’t come close to copper in terms of availability. The fact that this metal has existed longer than all other metals proves this. Humans have been using copper for more than 10,000 years, and its reign is far from over. It is not difficult to see why copper, despite the rise of many other non-ferrous metals, is still widely used. This has to do with its amazing properties. What are the properties and characteristics of copper? Our reliance on copper for many of our daily needs stems from the many properties that enable us to transform it into valuable material for the production of essential goods and services. Many other metals have similar properties but are either unstable or less abundant. Let’s examine some of the properties that make copper such a great metal. plasticity Copper can be beaten into sheets or plates without impact or hammering. In fact, such a wide range of copper thicknesses can be manufactured that distributors provide graphs of total copper plate thickness. Each option is available for very specific functions from machine plating to surface decoration. Copper can also be drawn into thin wires. Most cables used in buildings have copper cores. Unlike other metals that can break into strips, copper remains rigid even when drawn into very small diameter wires. Corrosion resistance Many artifacts dating back thousands of years are made of copper, showing us how long the metal can last. Of course, copper will corrode like any other metal. Only materials that can corrode it are not as common as other materials that can corrode other metals.

In addition, the industries that use them also belong to a complex group, including electronics, telecommunications and aerospace. Among all non-ferrous metals, copper is undoubtedly the best. Everyone knows about gold and silver, but they don’t come close to copper in terms of availability. The fact that this metal has existed longer than all other metals proves this. Humans have been using copper for more than 10,000 years, and its reign is far from over. It is not difficult to see why copper, despite the rise of many other non-ferrous metals, is still widely used. This has to do with its amazing properties. What are the properties and characteristics of copper? Our reliance on copper for many of our daily needs stems from the many properties that enable us to transform it into valuable material for the production of essential goods and services. Many other metals have similar properties but are either unstable or less abundant. Let’s examine some of the properties that make copper such a great metal. plasticity Copper can be beaten into sheets or plates without impact or hammering. In fact, such a wide range of copper thicknesses can be manufactured that distributors provide graphs of total copper plate thickness. Each option is available for very specific functions from machine plating to surface decoration. Copper can also be drawn into thin wires. Most cables used in buildings have copper cores. Unlike other metals that can break into strips, copper remains rigid even when drawn into very small diameter wires. Corrosion resistance Many artifacts dating back thousands of years are made of copper, showing us how long the metal can last. Of course, copper will corrode like any other metal. Only materials that can corrode it are not as common as other materials that can corrode other metals.  Conductivity It is not just the ductility of copper that makes it the material of choice for making wire cores. Copper also has excellent electrical conductivity. This metal is the second most conductive metal on Earth after silver. High heat capacity But what is the heat capacity of copper and what is it used for? Copper can withstand very high temperatures, including heat from high voltages, making it an ideal material for making electrical wires. While silver is more conductive, it can heat up quickly and cause a fire. Antibacterial properties Most non-ferrous metals have the ability to release ions that damage certain proteins in microorganisms, destroying them in the process. As the king of non-ferrous metals, copper can kill a large number of bacteria in a short time, which is why it is ideal for the manufacture of pipes and containers for water distribution and food processing. What are the uses of the copper plate? Copper can be produced in many forms, but the most popular is a flake. After all, there are many applications that require copper sheets. It is always used regardless of the thickness of the copper plate. This metal product is so popular that when you find you need it, you face the problem of not knowing where to buy copper. Below are some uses of copper sheets. welding equipment Before welding a product part, its geometry should be fixed with a welding tool to ensure the quality of the final product. Copper alloys are ideal for this type of application.

Conductivity It is not just the ductility of copper that makes it the material of choice for making wire cores. Copper also has excellent electrical conductivity. This metal is the second most conductive metal on Earth after silver. High heat capacity But what is the heat capacity of copper and what is it used for? Copper can withstand very high temperatures, including heat from high voltages, making it an ideal material for making electrical wires. While silver is more conductive, it can heat up quickly and cause a fire. Antibacterial properties Most non-ferrous metals have the ability to release ions that damage certain proteins in microorganisms, destroying them in the process. As the king of non-ferrous metals, copper can kill a large number of bacteria in a short time, which is why it is ideal for the manufacture of pipes and containers for water distribution and food processing. What are the uses of the copper plate? Copper can be produced in many forms, but the most popular is a flake. After all, there are many applications that require copper sheets. It is always used regardless of the thickness of the copper plate. This metal product is so popular that when you find you need it, you face the problem of not knowing where to buy copper. Below are some uses of copper sheets. welding equipment Before welding a product part, its geometry should be fixed with a welding tool to ensure the quality of the final product. Copper alloys are ideal for this type of application.  ground strap Any electrical system or machine must have a ground connection to protect essential components and personnel from electrostatic discharge (ESD). pipe fittings Copper, which is resistant to corrosion, is an ideal flash material. It even works on roofs, but because copper is expensive, many people don’t think it’s practical. power transfer Most sprockets, pulleys, and bushings used in powertrains are made of durable and wear-resistant metals. Many copper alloys meet the standard. heat exchanger Due to copper’s high heat capacity, most components in heat exchangers are made of copper or alloys. What is a piece of copper? Copper pieces, like steel pieces, are a valuable metal that is bought and sold on domestic and foreign markets every day. Copper is one of the ancient metals discovered by early humans 10 years ago. Some believe that copper was used as a Neolithic substitute around 8000 BC. Around 4000 BC hot copper was formed. Therefore, it can be considered much earlier than the birth of metallurgical science. What is copper? To understand what is copper piece, we will introduce copper here. As mentioned earlier, copper is one of the oldest metals that has been used in industry and various applications and has played an important role in the development of civilization.

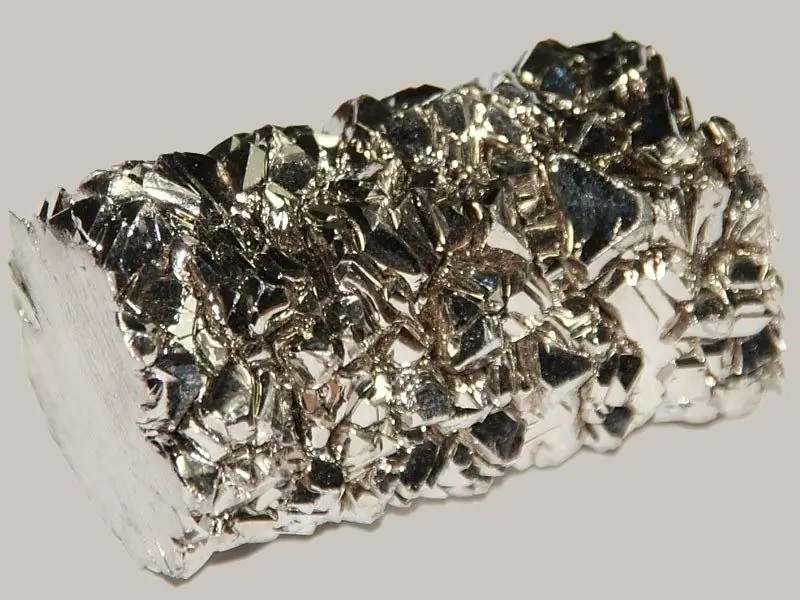

ground strap Any electrical system or machine must have a ground connection to protect essential components and personnel from electrostatic discharge (ESD). pipe fittings Copper, which is resistant to corrosion, is an ideal flash material. It even works on roofs, but because copper is expensive, many people don’t think it’s practical. power transfer Most sprockets, pulleys, and bushings used in powertrains are made of durable and wear-resistant metals. Many copper alloys meet the standard. heat exchanger Due to copper’s high heat capacity, most components in heat exchangers are made of copper or alloys. What is a piece of copper? Copper pieces, like steel pieces, are a valuable metal that is bought and sold on domestic and foreign markets every day. Copper is one of the ancient metals discovered by early humans 10 years ago. Some believe that copper was used as a Neolithic substitute around 8000 BC. Around 4000 BC hot copper was formed. Therefore, it can be considered much earlier than the birth of metallurgical science. What is copper? To understand what is copper piece, we will introduce copper here. As mentioned earlier, copper is one of the oldest metals that has been used in industry and various applications and has played an important role in the development of civilization.  Copper metal is a non-ferrous metal, sometimes necessary in industrial activities, which has been able to occupy the third place after iron and aluminum in global use. It is the 29th element in the periodic table. Copper bullion is a relatively valuable non-ferrous metal. But the price is lower than iron and alloy bars. Its flexibility and various properties make it widely used in various industries such as power, electronics, transportation, construction, plumbing, construction, and consumer and health products. Characteristics of copper The melting point of copper is 1083 degrees Celsius. Its main properties include high heat transfer coefficient, corrosion resistance and electrical conductivity. About copper pieces A billet is actually a form used to facilitate the transportation of metal and non-metal products. Most billets have a rectangular shape, which makes them easy to stack together. A copper rod is a variable volume mold made of copper ore used to produce wire, sheet, and other alloys. Types of copper blocks There are about 400 different copper and copper alloy compounds broadly grouped into the following categories:

Copper metal is a non-ferrous metal, sometimes necessary in industrial activities, which has been able to occupy the third place after iron and aluminum in global use. It is the 29th element in the periodic table. Copper bullion is a relatively valuable non-ferrous metal. But the price is lower than iron and alloy bars. Its flexibility and various properties make it widely used in various industries such as power, electronics, transportation, construction, plumbing, construction, and consumer and health products. Characteristics of copper The melting point of copper is 1083 degrees Celsius. Its main properties include high heat transfer coefficient, corrosion resistance and electrical conductivity. About copper pieces A billet is actually a form used to facilitate the transportation of metal and non-metal products. Most billets have a rectangular shape, which makes them easy to stack together. A copper rod is a variable volume mold made of copper ore used to produce wire, sheet, and other alloys. Types of copper blocks There are about 400 different copper and copper alloy compounds broadly grouped into the following categories:

- Pure copper ticket

- High purity copper alloy billet

- rice ticket

- Bronze ticket

- Copper Nickel Billet

- Silver Nickel Ticket

- Lead copper ticket

- Special alloy blocks

What are the properties of copper blocks? What are the properties of copper blocks? Some of the outstanding properties of high quality copper bolts are tensile strength, excellent gloss, standard durability, wear resistance and hardness to resist corrosion. This product is used worldwide for its anti-corrosion properties and good properties. This product is manufactured in a way that is resistant to any condition and range. Therefore, customers have the highest level of product quality. The copper pieces are made of pure material and made into different shapes for further processing. Basically, to produce the final item, you need hot and cold working or forming methods like milling and cutting. Semiconductors and non-metallic materials are produced in batches and called billets when cast by die casting. Commercial copper ingots are made from alloys or pure metals that are heated to their melting point using various heating methods.

What are the properties of copper blocks? What are the properties of copper blocks? Some of the outstanding properties of high quality copper bolts are tensile strength, excellent gloss, standard durability, wear resistance and hardness to resist corrosion. This product is used worldwide for its anti-corrosion properties and good properties. This product is manufactured in a way that is resistant to any condition and range. Therefore, customers have the highest level of product quality. The copper pieces are made of pure material and made into different shapes for further processing. Basically, to produce the final item, you need hot and cold working or forming methods like milling and cutting. Semiconductors and non-metallic materials are produced in batches and called billets when cast by die casting. Commercial copper ingots are made from alloys or pure metals that are heated to their melting point using various heating methods.

copper price LME

The foundations and current buildings of the London Metal Exchange are located in Paternoster Square near St Paul’s Cathedral in the City of London. The price of Copper and prices of metals are all registered in LME. The current structure and operation of the LME derive from its history and close links to physical metals trading. Since its establishment in the UK, the exchange has become a pioneering market for non-ferrous metals globally. The LME is a true end market that offers true delivery facilities to support its contracts. The exchange does not trade, conduct business or provide financial or physical services to clients. The LME simply provides a market in which transactions take place and provides regulation and transparency of the activities it conducts. The London Metal Exchange is the world’s largest trading market for non-ferrous metals, and base metals are traded to make up around 95% of global exchanges in this area. The stock exchange was first established in the 19th century. At the time, Britain was increasingly dependent on metal imports to supplement and replace the output of domestic mines it consumed. The largest imports are primary alloy metals, including tin from the Malaysia Straits and copper from newly constructed mines in Chile. The pricing and trading of these raw materials is irregular. Transport time is variable, information is scattered, and the trading market is irregular. Two factors contributed to this situation: the invention of the steamship (and the opening of the Suez Canal) and the invention of the telegraph. Transit times are now (usually) predictable and information about the ship and its cargo is available before it arrives in London. Businessmen invest a lot of money in these high-risk ventures and hope to make some profit.  As a result, London’s metal dealers began meeting in the city’s cafes, particularly the “Jerusalem Cafe”, to trade future metal shipments. The metal trade in these cafes reflected the development on the stock market. In 1877, trade grew so fast for the merchants that they were able to create a company called the Metalmarkeds- og Handelsselskabet and take over a building dedicated to the metal trade. Soon the final price will be announced and the final parts of the LME infrastructure will be ready. Now this market acts as a price reference. In fact, this market is a place where the risk of price changes can be neutralized through early trading and real metals can be bought and sold. In this way, the stock exchange was established as a market to control risks in the metal industry. Regardless of what has changed over the years, the stock market exists for exactly the same reason that the 19th-century Jerusalem café trades. Today, trading is still an integral part of real metal processing and acquisition, as metal ores are often found in unsuitable locations and far from major consumption areas; therefore, the LME provides access to a much-needed service for everyone who produces, stores, trades or consumes metals. Since 1 January 2001, the structure of the exchange is controlled by a company called “London Metal Exchange Limited”, which is a subsidiary of “LME Hold Young’s Limited” and is 100% owned by it. The holding company is now a private company and its shareholders are stockbroker members, trade clearing members and trading members who choose to carry out their share-related duties. These trading members are the only members who are not required to be shareholders in the owner company. Membership categories are described later in this chapter. The purpose of the LME is to provide facilities for the management and legal structure of trade in non-ferrous metals.

As a result, London’s metal dealers began meeting in the city’s cafes, particularly the “Jerusalem Cafe”, to trade future metal shipments. The metal trade in these cafes reflected the development on the stock market. In 1877, trade grew so fast for the merchants that they were able to create a company called the Metalmarkeds- og Handelsselskabet and take over a building dedicated to the metal trade. Soon the final price will be announced and the final parts of the LME infrastructure will be ready. Now this market acts as a price reference. In fact, this market is a place where the risk of price changes can be neutralized through early trading and real metals can be bought and sold. In this way, the stock exchange was established as a market to control risks in the metal industry. Regardless of what has changed over the years, the stock market exists for exactly the same reason that the 19th-century Jerusalem café trades. Today, trading is still an integral part of real metal processing and acquisition, as metal ores are often found in unsuitable locations and far from major consumption areas; therefore, the LME provides access to a much-needed service for everyone who produces, stores, trades or consumes metals. Since 1 January 2001, the structure of the exchange is controlled by a company called “London Metal Exchange Limited”, which is a subsidiary of “LME Hold Young’s Limited” and is 100% owned by it. The holding company is now a private company and its shareholders are stockbroker members, trade clearing members and trading members who choose to carry out their share-related duties. These trading members are the only members who are not required to be shareholders in the owner company. Membership categories are described later in this chapter. The purpose of the LME is to provide facilities for the management and legal structure of trade in non-ferrous metals.  Although the company’s activities are closely related to the trading of physical metals, the company must comply with the legal framework of the Financial Services and Markets Act 2000. As such, it is a recognized investment exchange (RIE) directly regulated by the Financial Services Authority (FSA). The law strictly defines the conditions under which the exchange operates and most importantly, as an RIE, it must maintain a safe market in all its contracts. The London Metal Exchange (LME) was founded in 1877 and celebrated its 130th anniversary two years ago. Although the LME has always been a dynamic and changing exchange, it has always relied on traditional methods to retain customers, trade contracts in a smooth and continuous flow to meet the growing expectations of the industry and win the trust of users. The LME is finalizing a two-for-two strategy that will see the exchange grow from non-minerals to mineral metals and from futures contracts to over-the-counter market facilitation mechanisms. There are also plans to double the exchange’s trading volume over the next three to five years. International trade in metals began in England when the Romans invaded the country in 43 BC. and seized vast quantities of metals and mines in Cornwall and Wales to meet the growing domestic demand for bronze and alloy production. In any case, the origins of the LME can be traced back to the opening of the Royal Stock Exchange in London in 1571 under Queen Elizabeth I. This is a place where merchants regularly exchange metals and other commodities. At first, merchants only traded metals for domestic needs, but as Britain became the largest exporter of metals, European merchants soon joined these activities. At the beginning of the 19th century, the Royal Stock Exchange was used by many merchants, ship owners, and capitalists, which made a large number of stock exchanges unable to do business, so a group of merchants set up in person around the town’s cafes.

Although the company’s activities are closely related to the trading of physical metals, the company must comply with the legal framework of the Financial Services and Markets Act 2000. As such, it is a recognized investment exchange (RIE) directly regulated by the Financial Services Authority (FSA). The law strictly defines the conditions under which the exchange operates and most importantly, as an RIE, it must maintain a safe market in all its contracts. The London Metal Exchange (LME) was founded in 1877 and celebrated its 130th anniversary two years ago. Although the LME has always been a dynamic and changing exchange, it has always relied on traditional methods to retain customers, trade contracts in a smooth and continuous flow to meet the growing expectations of the industry and win the trust of users. The LME is finalizing a two-for-two strategy that will see the exchange grow from non-minerals to mineral metals and from futures contracts to over-the-counter market facilitation mechanisms. There are also plans to double the exchange’s trading volume over the next three to five years. International trade in metals began in England when the Romans invaded the country in 43 BC. and seized vast quantities of metals and mines in Cornwall and Wales to meet the growing domestic demand for bronze and alloy production. In any case, the origins of the LME can be traced back to the opening of the Royal Stock Exchange in London in 1571 under Queen Elizabeth I. This is a place where merchants regularly exchange metals and other commodities. At first, merchants only traded metals for domestic needs, but as Britain became the largest exporter of metals, European merchants soon joined these activities. At the beginning of the 19th century, the Royal Stock Exchange was used by many merchants, ship owners, and capitalists, which made a large number of stock exchanges unable to do business, so a group of merchants set up in person around the town’s cafes.  Made the Jerusalem cafe one of the best. A gathering place for famous merchants to exchange metals; where the traditional barter circle was born, this circle is actually a circle where merchants who want to sell metal will draw a circle on the ground with sawdust, called “barter”, and those who want to barter. People who want to buy things gather around that circle and give a price. At the beginning of the 19th century, Britain became self-sufficient in copper and tin, and the prices of these metals were stable for a long time. In November 1981 the copper contract was upgraded to high-grade copper and today it is upgraded to a Class A contract. Current in trading started after a brief hiatus when the building collapsed in June 1989. Lead and zinc began trading in 1920, previously informally, and their contracts have remained unchanged since October 1952, when lead re-emerged after the closure of the exchange during World War II, but zinc has changed quality several times. Primary aluminum was consumed in December 1978, and today its high-grade contracts have been trading since August 1987. Nickel trading began the following year with aluminum and aluminum alloy trading in October 1992 and silver trading in May 1999. Index contracts on the LME are based on the six major metals launched in 2000. The index metal base is designed for investors to obtain options and futures contracts based on non-mineral base metals that do not require physical delivery. In May 2005, the LME launched the first plastic futures contracts for propylene and low-density polyethylene in addition to the regional contracts from 2007. LME MINIS is the latest trading instrument for copper, aluminum, and zinc, launched in December 2006.

Made the Jerusalem cafe one of the best. A gathering place for famous merchants to exchange metals; where the traditional barter circle was born, this circle is actually a circle where merchants who want to sell metal will draw a circle on the ground with sawdust, called “barter”, and those who want to barter. People who want to buy things gather around that circle and give a price. At the beginning of the 19th century, Britain became self-sufficient in copper and tin, and the prices of these metals were stable for a long time. In November 1981 the copper contract was upgraded to high-grade copper and today it is upgraded to a Class A contract. Current in trading started after a brief hiatus when the building collapsed in June 1989. Lead and zinc began trading in 1920, previously informally, and their contracts have remained unchanged since October 1952, when lead re-emerged after the closure of the exchange during World War II, but zinc has changed quality several times. Primary aluminum was consumed in December 1978, and today its high-grade contracts have been trading since August 1987. Nickel trading began the following year with aluminum and aluminum alloy trading in October 1992 and silver trading in May 1999. Index contracts on the LME are based on the six major metals launched in 2000. The index metal base is designed for investors to obtain options and futures contracts based on non-mineral base metals that do not require physical delivery. In May 2005, the LME launched the first plastic futures contracts for propylene and low-density polyethylene in addition to the regional contracts from 2007. LME MINIS is the latest trading instrument for copper, aluminum, and zinc, launched in December 2006.

Your comment submitted.