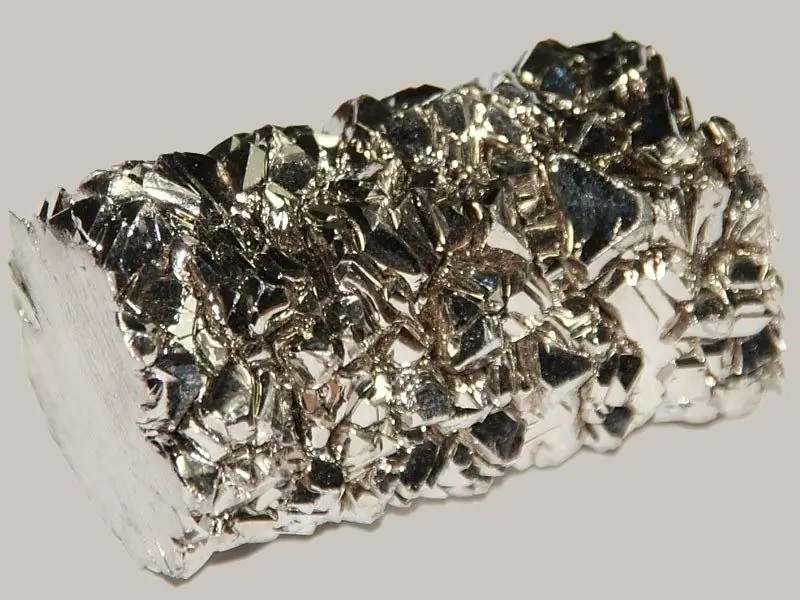

The global nickel industry has displayed remarkable resilience amidst the ever-changing landscape of the commodities market. As one of the essential elements for stainless steel manufacturing, nickel’s price movements hold significant influence over various industries worldwide. In this article, we delve into an analysis of the current factors impacting nickel prices and present a forecast for the future.

Current Market Trends

Over the past decade, the nickel market has experienced notable price volatility. In 2019, nickel prices surged to a five-year high due to a ban on exports of unprocessed ore in Indonesia, the world’s largest nickel producer. This, coupled with increased demand from the electric vehicle (EV) industry, pushed prices higher. However, the onset of the COVID-19 pandemic disrupted global supply chains, leading to a temporary decline in nickel prices in early 2020.

Factors Influencing Nickel Prices

1. Nickel Supply:

The supply side dynamics play a significant role in determining the price of nickel. Indonesia has relaxed its earlier ban on ore exports, thereby increasing the global nickel supply. Companies are ramping up production to meet the rising demand from stainless steel manufacturers and the emerging EV sector. Additionally, the ongoing transition towards electric vehicles is expected to boost demand for nickel, as it is a crucial component in EV batteries.

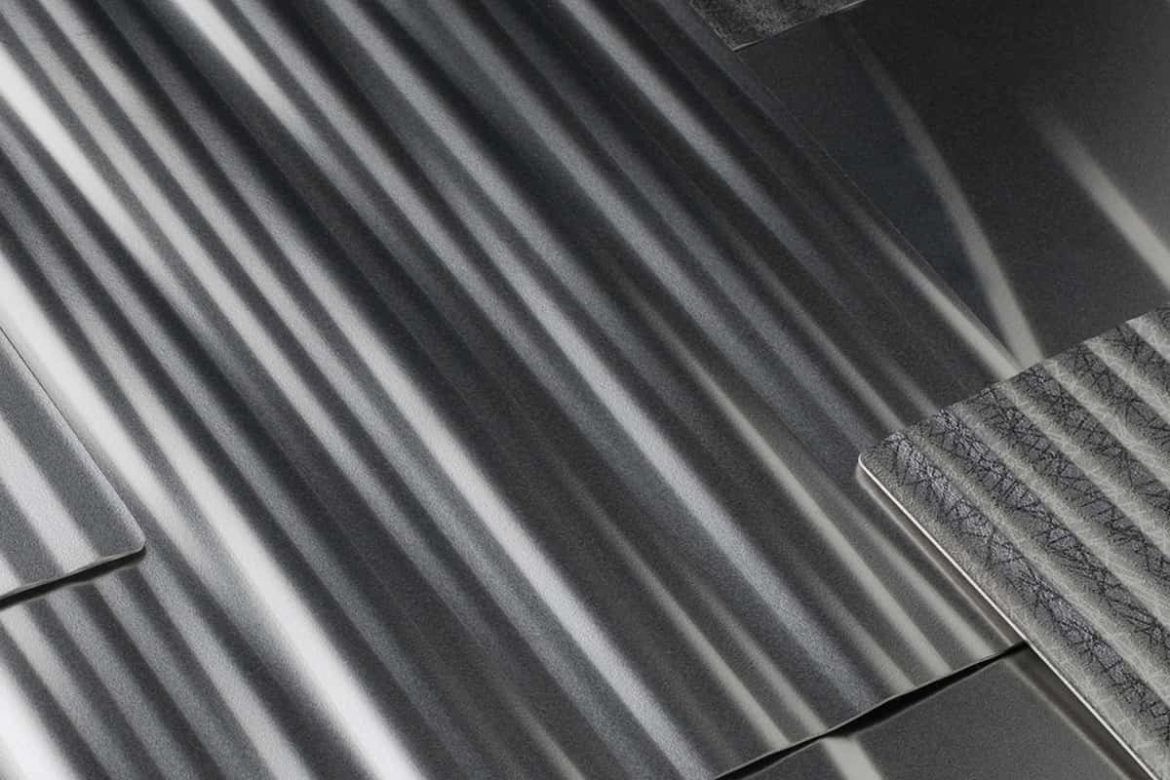

2. Stainless Steel Industry:

The stainless steel sector accounts for nearly 70% of global nickel demand. Any changes in stainless steel production can lead to swings in nickel prices. The construction and infrastructure sectors are the biggest consumers of stainless steel, and as the world economy recovers from the pandemic’s impact, demand for stainless steel is expected to rise. This, in turn, will have a positive impact on nickel prices.

3. Electric Vehicle Revolution:

As countries strive towards decarbonization and embrace renewable energy sources, the demand for EVs is set to soar. Nickel is a vital component in lithium-ion batteries used in electric vehicles. With major economies including the United States, Europe, and China aggressively promoting the adoption of electric vehicles, the demand for nickel is anticipated to increase sharply. As a result, this surge in EV production will have a significant impact on nickel prices.

Nickel Price Forecast

While predicting the future with certainty is challenging, industry experts believe that the outlook for nickel prices remains optimistic.

1. Short-Term Forecast:

In the short term, nickel prices are expected to remain stable. As the global economy recovers and industries return to pre-pandemic levels, stainless steel demand will pick up, positively impacting nickel prices. The lifting of export bans in Indonesia will further contribute to the stabilization of the nickel market.

2. Medium-to-Long-Term Forecast:

The medium-to-long-term forecast for nickel prices looks promising. With the ongoing transition to electric vehicles, the demand for nickel is set to surge. Lithium-ion batteries require a substantial amount of nickel, and the lack of available supply could result in a deficit. This projected imbalance between supply and demand could lead to a further increase in nickel prices.

The nickel market is poised for a positive future as demand from stainless steel manufacturers and the EV industry continues to grow. While short-term stability can be expected, the long-term forecast suggests a bullish trend for nickel prices, driven by the increasing demand for electric vehicles. Investors and industry stakeholders would be wise to closely monitor developments in the nickel market as they plan for the future.

As the global transition towards cleaner energy gains momentum, nickel’s significance as a critical component in batteries makes it a hot commodity. By carefully considering the various factors affecting the nickel market, businesses can make informed decisions and seize opportunities presented by the projected rise in nickel prices.

Your comment submitted.