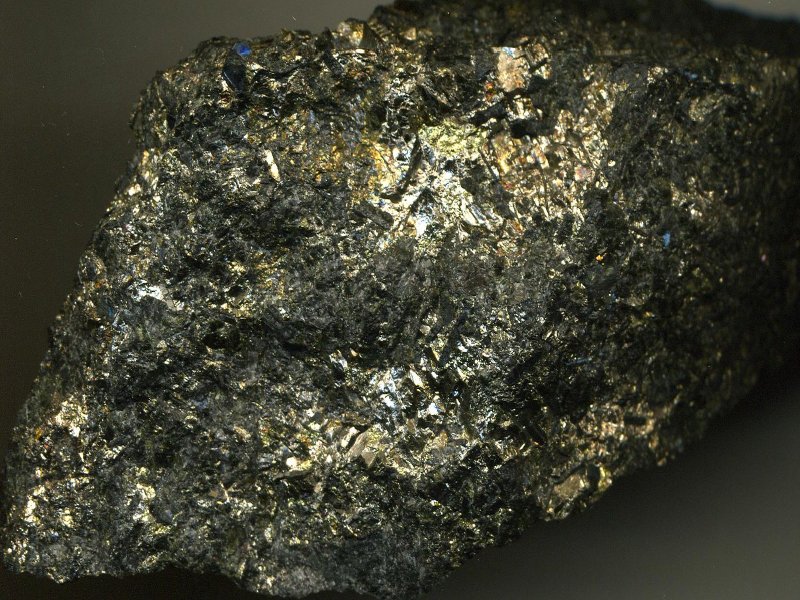

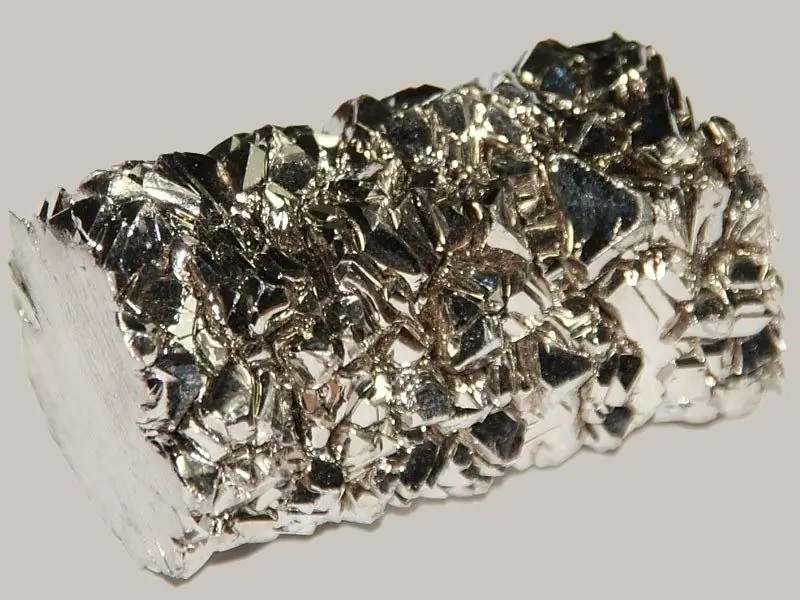

In recent years, the nickel price in India has experienced significant fluctuations, leaving many investors, manufacturers, and consumers bewildered about its underlying causes and implications. As a vital component in various industries, such as stainless steel manufacturing and battery production, the price of nickel plays a crucial role in shaping the economic landscape. This article aims to shed light on the key factors driving the nickel price in India, their impact on the market, and the outlook for the future.

Demand-Supply Dynamics

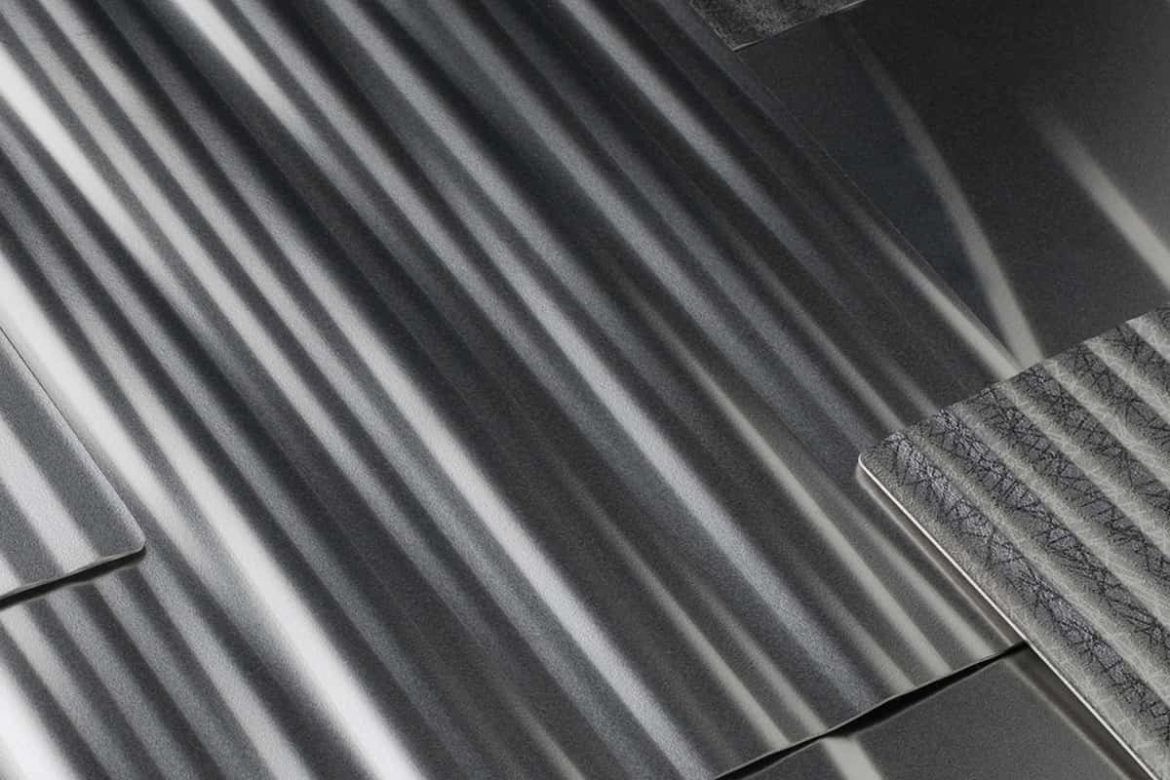

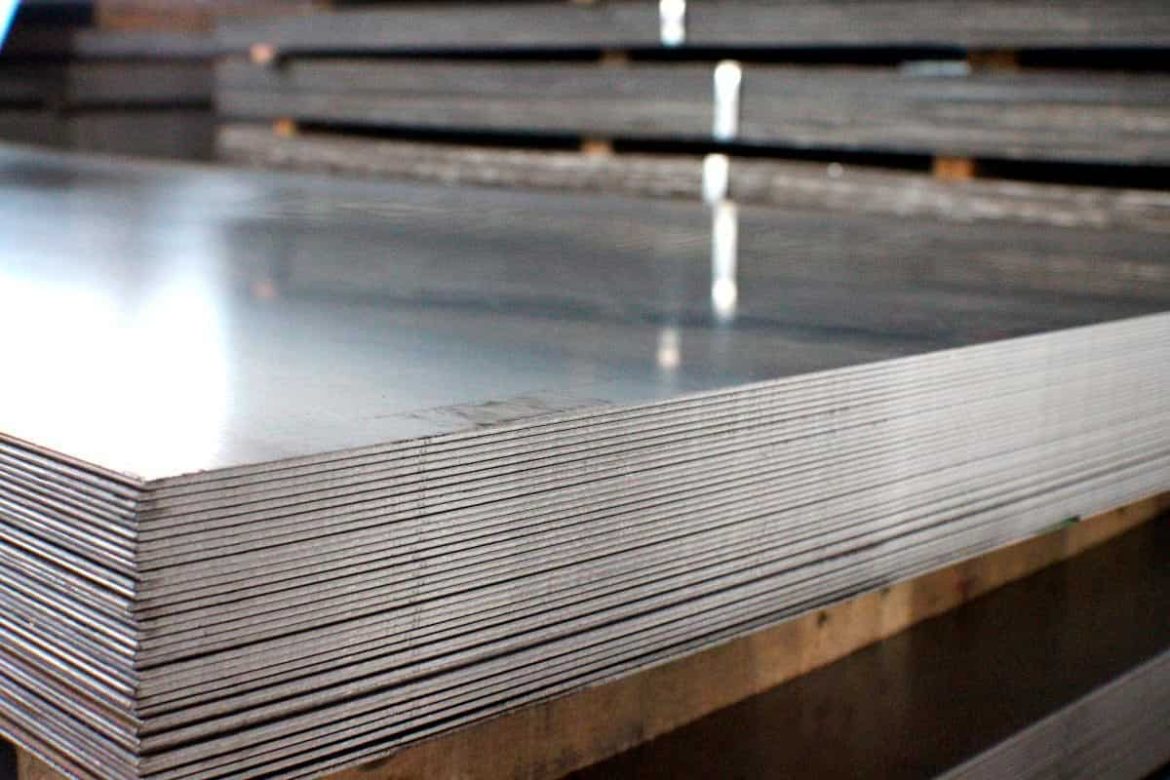

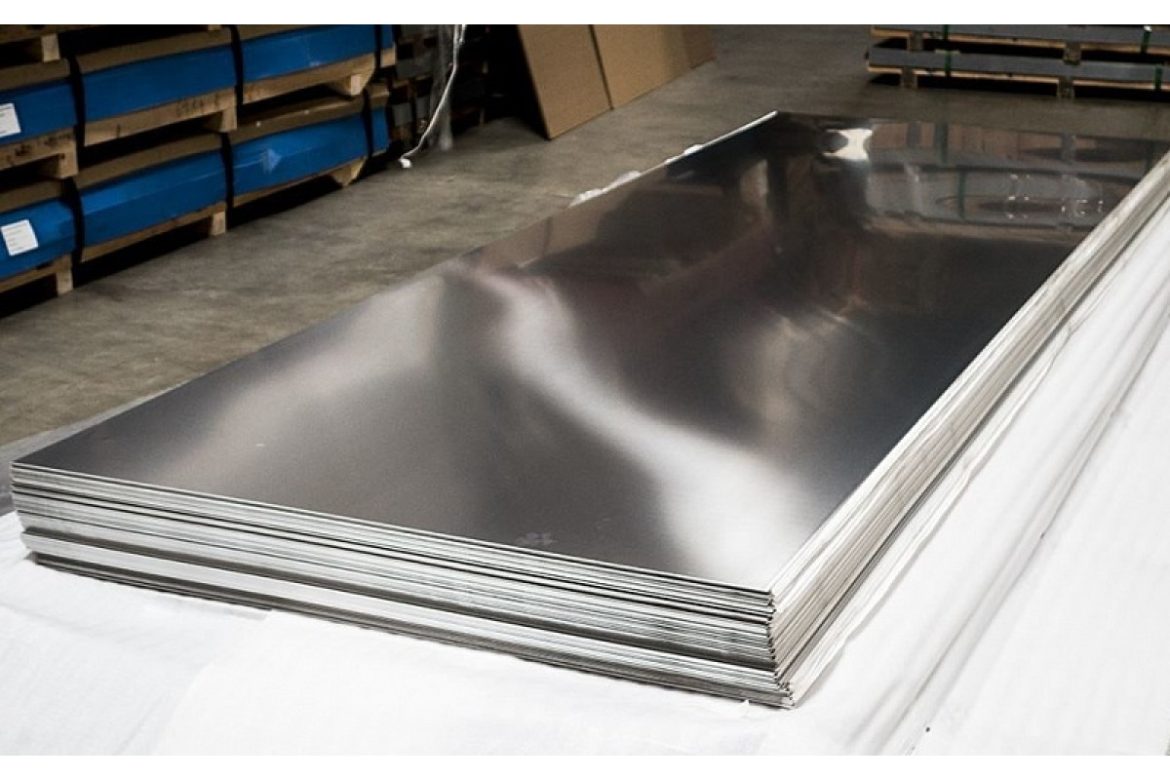

Demand and supply dynamics have a significant influence on the nickel price in India. The stainless steel industry is the largest consumer of nickel, accounting for around 70% of global demand. Any fluctuations in stainless steel production can swiftly affect the nickel market. Similarly, the growing demand for electric vehicles (EVs) and renewable energy storage systems, which rely on nickel-rich batteries, has also exerted pressure on the nickel market, causing fluctuations in the price.

Government Policies and Environmental Regulations

Government policies and environmental regulations add another layer of complexity to the nickel price in India. The Indian government’s push towards the electrification of transportation and investment in renewable energy has led to an increased demand for nickel in recent years. Additionally, stricter environmental regulations imposed on mining operations in various countries can disrupt the global supply chain, creating a ripple effect on nickel prices.

Global Macroeconomic Factors

Global macroeconomic factors, such as economic growth, trade tensions, and currency exchange rates, can significantly impact the nickel price in India. Fluctuations in the global economy, particularly in major nickel-consuming countries like China and the United States, can lead to shifts in demand and ultimately influence prices. Similarly, any shifts in currency exchange rates can affect the competitiveness of Indian nickel exporters, potentially impacting prices in the domestic market.

Price Volatility and Speculation

The nickel market is known for its inherent price volatility, driven in large part by speculative trading activities. Speculators often take advantage of market uncertainties and short-term fluctuations to create additional price swings. Such speculation can amplify price volatility, making it difficult to predict future trends accurately. It is crucial for investors, consumers, and manufacturers to monitor these speculative activities and assess their potential impacts on the nickel price in India.

Future Outlook

Looking ahead, several factors give reason for optimism regarding the nickel price in India. The increasing demand for EVs and renewable energy storage systems is expected to sustain a robust demand for nickel. Furthermore, the Indian government’s proactive policies aimed at promoting domestic manufacturing and reducing dependence on imports could help stabilize the nickel market. However, continued fluctuations in global economic conditions and the uncertainty surrounding environmental regulations remain key factors to monitor in order to gauge the future trajectory of the nickel price in India.

Understanding the factors influencing the nickel price in India is essential for investors, manufacturers, and consumers. By keeping a close eye on demand-supply dynamics, government policies, global macroeconomic factors, and speculative activities, stakeholders can make informed decisions and mitigate potential risks arising from nickel price fluctuations.

Your comment submitted.